Our Investment Philosophy

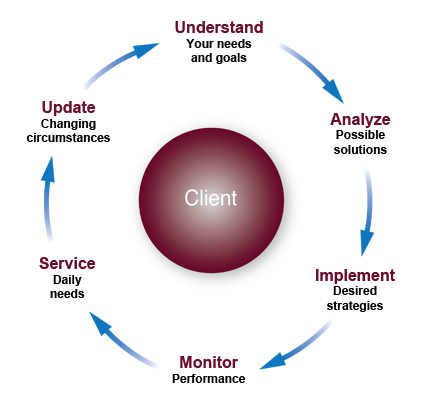

As advisors we recognize that each client is unique, possessing different financial needs, desires, and goals. As experts in understanding the investment process, we know it is important to stay attuned to both our clients’ needs, and to the markets. For example, we know that one of the most important determinants to our client’s long-term success is the asset allocation of their investment portfolio.

The asset allocation process begins with our meeting to identify your goals, and to define a realistic time horizon for reaching them. We also examine your personal tolerance for risk. Often times a sound long-term asset allocation strategy is undermined, or even abandoned, because an investor experiences more short-term market fluctuation than can be tolerated.

Once these parameters are defined, we work together to create an investment portfolio and financial plan that is comfortable, and that will best position you to reach your financial goals. This process is a continual one. Personal changes such as an inheritance, a raise, job loss, illness, or retirement, may affect your specific goals, time horizon, or risk tolerance, and thus require a shift in your portfolio asset allocation. Also changes in the market over time may require periodic rebalancing of your portfolio. As a general rule, your portfolio’s asset allocation should be reviewed at least twice annually to ensure that it still accurately reflects your goals and your circumstances.